Iran Sukuk Market in 2021

In Iran Capital Market, various debt securities are traded; including: General Murabaha, Islamic Treasury, Musharaka, SPV securities, Productive Credit Certificates and Salaf, but this report focuses on the securities issued by SPVs which are mentioned here as sukuk. According to the Guidelines for SPVs Activities ratified by Securities and Exchange High Council of Iran the only entity authorized to establish and manage SPVs is the Capital Market Central Asset Management Company.

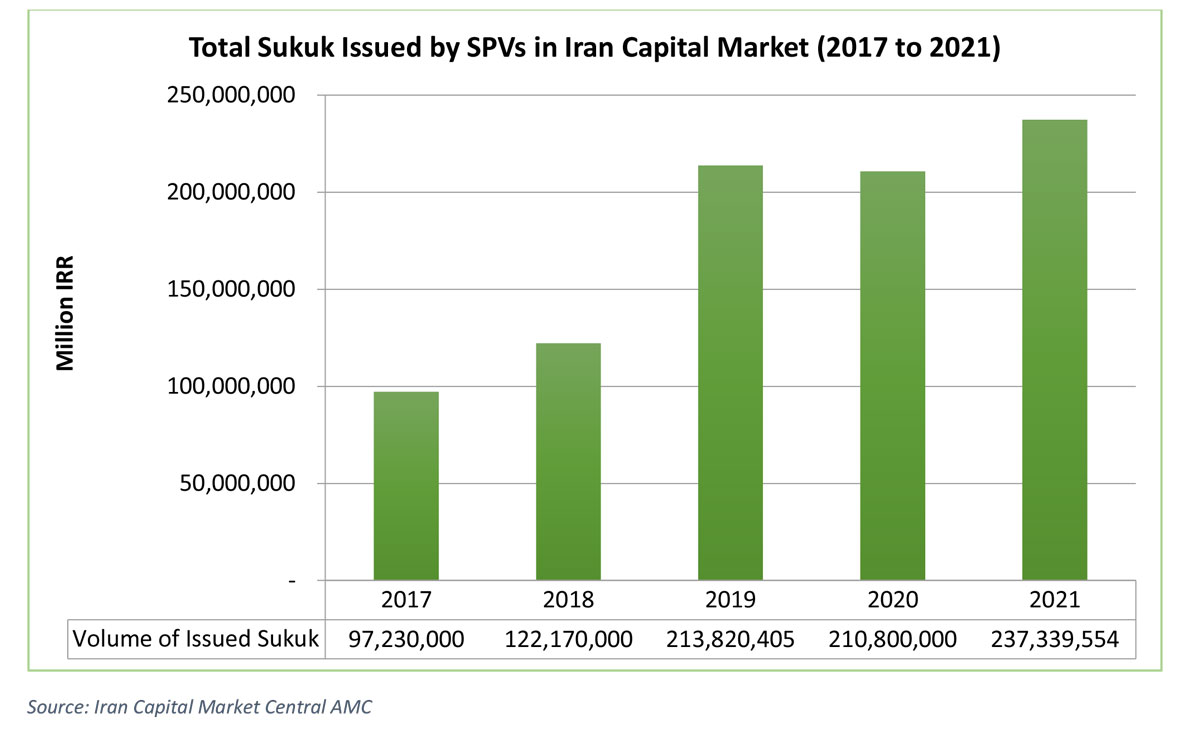

Since the enactment of the Law for Development of New Financial Instruments and Institutions in late 2009 there have been 117 sukuk issuances to the end of 2021 amounting to 942 trillion IRR under various Islamic contracts such as: Ijarah, Murabaha, Manfaah, Istisna, Mortgage Backed and Asset Backed. Total outstanding sukuk issued by SPVs reached to 724 trillion IRR at the end of 2021.

Sukuk key transaction documents consist of, Prospectus, Islamic Contract (Ijarah, Murabaha, etc.), Guarantee/Collateralization/Rating documents, Market Making Contract, Underwriting Contract, Sales Management Contract and Payments Management Contract.

Key players of sukuk issuance in Iran capital market include Securities and Exchange Organization as the regulator, Shariah Board of SEO, Corporates or Government as the originators, Capital Market Central AMC as the establisher and manager of SPVs, Investment Banks and Financial Institutions as lead managers, Central Securities Depository of Iran as the agent of payment, IFB and TSE as the exchanges, Credit Rating Agencies, and Banks or Financial Institutions as the guarantors.

In Iran capital market, all sukuks issued by SPVs are publicly placed through Tehran Stock Exchange or Iran Fara Bourse with a maturity of 1 to 5 years. They are commonly purchased by Investment funds, Investment Banks and Companies, and not often by the Individuals.

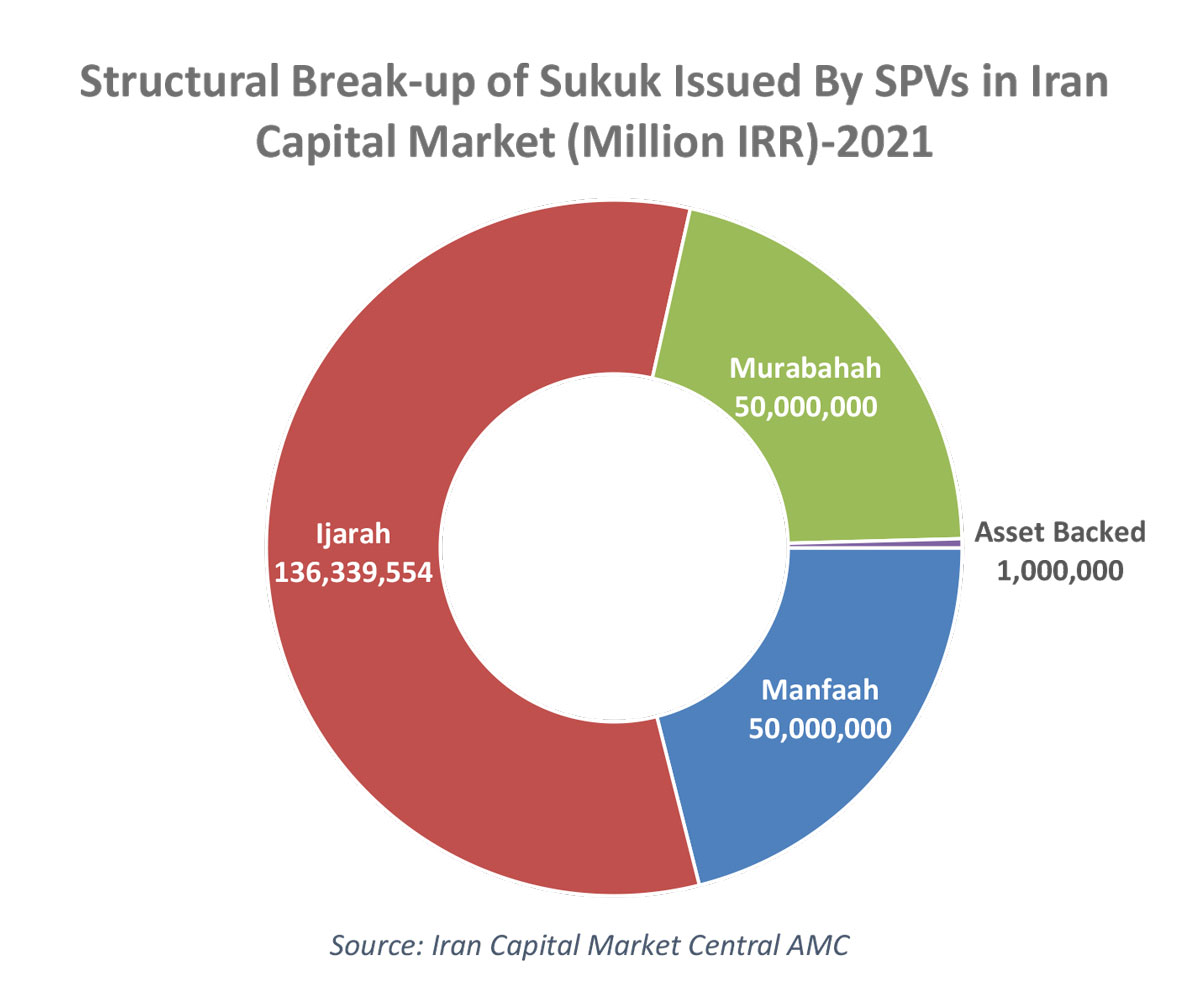

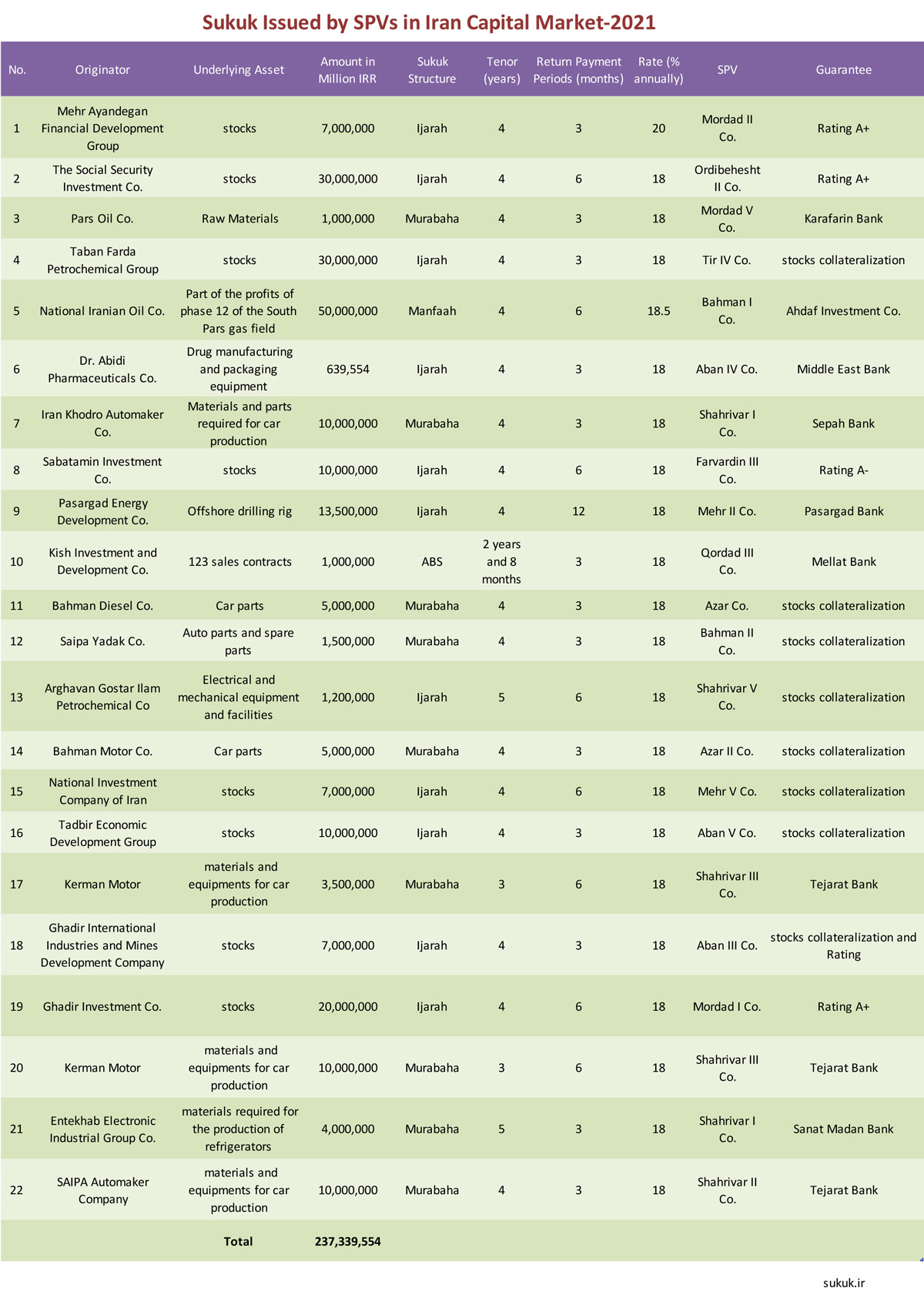

In 2021, Iranian corporates raised more than 237 trillion IRR through SPV sukuk issuances and the government used other financial instruments which did not require SPVs including: Islamic Treasury, General Murabaha, Salaf and etc.

The sukuk issued in 2021 include a diverse range of underlying assets such as: sale contracts, drill rig, car parts, raw materials, future revenues from the gas fields and stocks.

In Iran capital market, credit rating is not mandatory for issuing sukuk while in 2021, for the first time in the past 11 years some sukuk were issued based on their credit rating determined by local credit rating agencies.

According to guidelines on issuance of sukuk in Iran capital market, the sukuk originators are required to guarantee the payment of distribution amounts and principal through providing third person guarantee and/or corporate and sukuk credit rating and/or stocks collateralization.

Sukuk issuance is expected to rise in Iran capital market in 2022 considering the recent initial permits given by the Securities and Exchange Organization of Iran to 23 corporates looking to raise funds through issuing sukuk by SPVs amounting to over 200 trillion IRR.

Written by: Masoud Zohrehvandi- a member of the International Relations Committee at the Iranian Association of Islamic Finance and the public relations officer of the Capital Market Central Asset Management Company. He can be contacted at masoudzmail@gmail.com.